It is tax time — What does my business need to know about Australian tax time?

For every entrepreneur, the moment they register a company is the moment when everything starts. This is the first step towards turning your ideas into reality, but running a company also brings a set of potentially stressful tasks you need to complete.

One of such tasks no responsible entrepreneur can escape is taking care of taxes. Australian tax system obliges both individuals and companies to follow certain rules regarding tax payments, which can often appear confusing to novice entrepreneurs.

In order to help you better understand your responsibilities related to Australian tax calendar, we’ll outline some of the most important concepts you need to understand.

New tax changes 2014/2015

The Australian Government occasionally introduces changes to the country’s tax system and it is very important for entrepreneurs to stay up to date with the current system. Typically, these changes do not make a major difference for every company, but can sometimes be significant for some specific businesses.

In 2014/2015, some of the most important changes were the increase in Medicare levy from 1.5% to 2% and the elimination of the ability to carry back losses to previous tax year for the 2013/2014 financial year. The list of all the other changes is available here and you should definitely take a look at these to make sure your business won’t overlook something important.

Tax tables and types of taxes that apply to your business

Depending on your business’s size and area of operation, you will need to pay different types of taxes. The full list of tax tables that apply from 1 July 2015 is available on the Australia Taxation Office website, which also specifies the information on where you can find guidance through the process. Normally you need to fulfill specific criteria in order to be registered for a specific type of tax and you should ensure you’ve read through all the information that applies to your own business.

Deadlines: key dates for 2014/2015.

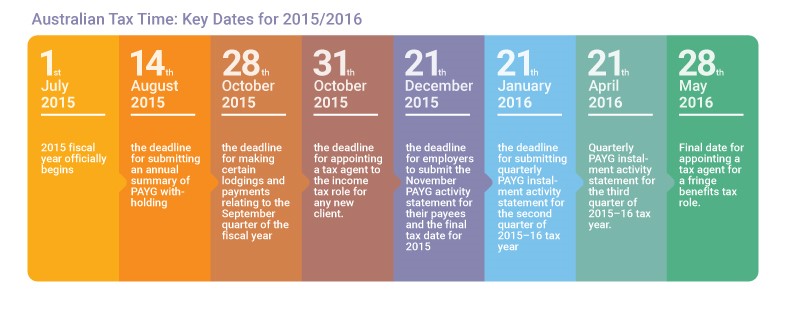

The financial year for tax payments is not entirely in accordance with the regular calendar we use in our daily lives. This is why Australian Taxation Office publishes key dates on their website and updates this tax calendar regularly. An important thing to understand in relation to these dates is the fact you cannot receive an extension if you’re submitting on your own. If you’re using a registered agent for this purpose, you can get an extension for some dates.

Regardless of the manner of submission, however, you need to make sure you know what the key dates are. Hopefully, you’ll find this easier with our quick visual guide to the most important days in 2015/2016 tax year.

Calculating on your own

Now that you’re familiar with the basics of the Australian tax system, you can calculate the exact sums of money your business needs to pay on your own. With an aim of helping you with this, ATO created two helpful calculators that enable you to calculate exactly how much you’re due.

– Tax withheld for individuals calculator is a tool you should use if you’re making regular payments to official employees or other people, while

– Voluntary agreement calculator should be used by businesses that hire contractors, volunteers and other types of workers.

Both of these resources are created to help you understand the aspects that are included in the tax. As further explained on the website, the calculators take into account references such as income tax rates, Medicare levy, temporary budget repair levy, and several others.

Eligibility for tax deduction

As one of the incentives for the development of small businesses, the Australian government provides a set of tax deduction opportunities to help you save on some critical business resources. Again, depending on the size and structure of your business, you may be eligible for different types of tax deduction.

However, in addition to some common deductions such as vehicle and travel expenses or gifts and donations, there are also some rather uncommon tax deductions that you might not be even familiar with. One of the features of these deductions that they usually apply only to a limited number of businesses.

Because of their specificity, Australians often tend to make fun of them and even consider them bizarre. The whole list of such deductions is collected by Sydney Morning Herald and includes employee entertainment equipment such as Xboxes or ping-pong tables, food and vet bills for guard dogs, as well as backyard studios that are typically less convenient than some city offices.

Tools and resources to make your life easier

Given that tax payments are obligatory for both individuals and business owners, it’s unsurprising that ATO expects 12 million Australians to lodge a tax return this year. Those among them who recently started running a business may have some troubles doing everything right. Fortunately, there are a number of tools and resources that can help them in the process. The most important ones are:

– myTax, an online lodgement service created by ATO to help you prepare your own tax returns in an easy way. To be able to access myTax, you need to have a myGov account created and linked to ATO. myTax is also available on smartphones, which additionally facilitates the process of preparing tax return.

– ATO Business Portal, a secure website that lets you manage your business registration details, view your payment options, prepare Business Activity Statements (BAS) and anything else you may need to manage your taxes.

– Payment Plan Calculator, another tax calculator intended to help businesses work out an efficient payment plan. Payment Arrangement Calculator helps you calculate the time you would need to pay off your tax debt, and you can also use it as a guide to propose a payment plan.

Conclusions

Like all the other countries, Australia has its specific taxation system that functions through Australian Taxation Office. The time of the year when tax is due, is rarely a moment one welcomes with smiles, but it’s certainly something you can’t avoid. For businesses, this is particularly important because it may be quite complex to handle, let alone the consequences it may bring if not everything is done right.