Understanding Customer Relationships: Part 2

So, now that we understand all about customer relationships, motivations, and value from our previous Part 1 article, it’s time to understand how you can benefit from Customer Relationship Management (CRM). We detail the customer relationship lifecycle to help you get a firm hold onto how customers can be acquired, retained, and developed to add value and profitability for both your business and its customers.

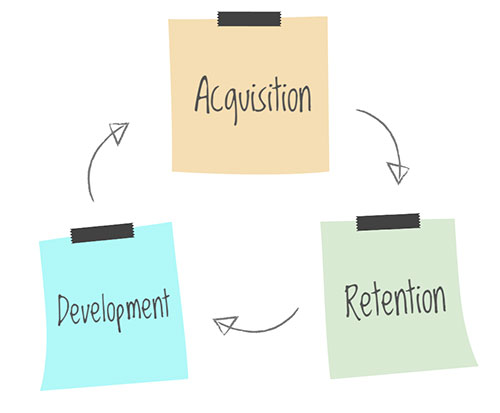

Customer Relationship Lifecycle

Acquisition — attracting new customers

Retention — keeping a high proportion of current customers (by reducing customer defections)

Development — increasing the value of retained customers to the company

Or possibly, termination.

Acquisition

When seeking to acquire new customers, businesses must take into consideration some key questions:

- How valuable is the customer?

- What is the cost to acquire a new customer?

- If a customer switches, what proportion of that spending will your business earn?

- What is the probability that the customer will switch from his/her current suppliers?

- Are the customers strategic switchers and/or portfolio purchasers?

But before all this, is the first and most important decision in customer acquisition — prospecting, or lead generation. This involves searching for consumers that can have the potential to become new customers.

For Business-to-business (B2B) organisations, there is a wide range of sources and methods for generating leads, such as: referring customers, promotional activities, networking, websites, lists and directories, and email.

For Business-to-customer (B2C) organisations, the sources and methods are somewhat different. Typically, they involve advertising, sales promotions, buzz marketing/word-of-mouth, viral marketing, referral programs, merchandising, websites, and many others. There may be some methods of prospecting suitable for particular businesses/industries. As examples, fashion shows for retailers, special events for new customers, publicity stunts, and pitchers or SMS messaging for bars/clubs or cinemas.

Retention

There are a few questions to ask when planning customer retention, such as:

1. Which customers should be targeted?

Firstly, the types of customers that should be target are the business’s strategically significant customers, who can be categorised as:

- High volume customers— these customers can be considered as a necessity, as they might not generate much profit but absorb fixed costs, and the economies of scale they generate keep unit costs low

- Benchmark customers — other customers follow these customers.

- Inspirations — these are customers who bring about improvements by, for example, identifying new product applications, improvements, or opportunities for cost reductions

- Door openers — these customers allow the supplier to gain access to a new market, which may be done for no initial profit, but with a view to proving credentials for further expansion

2. What objectives should be set?

Secondly, your objectives should be set high, but achievable — i.e. to keep the highest portion of valuable customers.

3. What strategies will be used?

Thirdly, there are many positive strategies that can be used to retain high value customers:

- Delight the customer –do the unexpected, or above-and-beyond to satisfy them

- Create customer-perceived value — through loyalty/reward programs, customer clubs, sales promotions, etc.

- Create social and structural bonds — social bonds are positive relationships between individuals (including empathy, responsiveness, reliability), whereas structural bonds involve investments linked customer and organisation (financial, legal, technological)

- Create customer engagement — customers like being interacted with, it makes them feel recognised and valued; possibly the best way to do this nowadays is through unpaid forms of advertising like social media

And there are also some negative strategies that can be highly risky:

- Create exit barriers

- Enforce contracts

- Extract switching penalties

4. How will the performance be measured?

Lastly, there are 3 ways to measure customer retention:

- Raw retention rate — no. of customers at the end of a trading period as % of active customers at the beginning of a period

- Sales-adjusted retention rate — value of sales from retained customers as % of profit earned from all active customers at the beginning of a period

- Profit-adjusted retention rate — profit from retained customers as % of profit earned from all active customers at the beginning of a period

Development

Customer relationships can be prolonged and value can be added in the development stage of the customer lifecycle. This stage seeks to enhance the profitability of existing customers and broaden the customer-organisation relationship. The main forms of customer development include (but are not limited to):

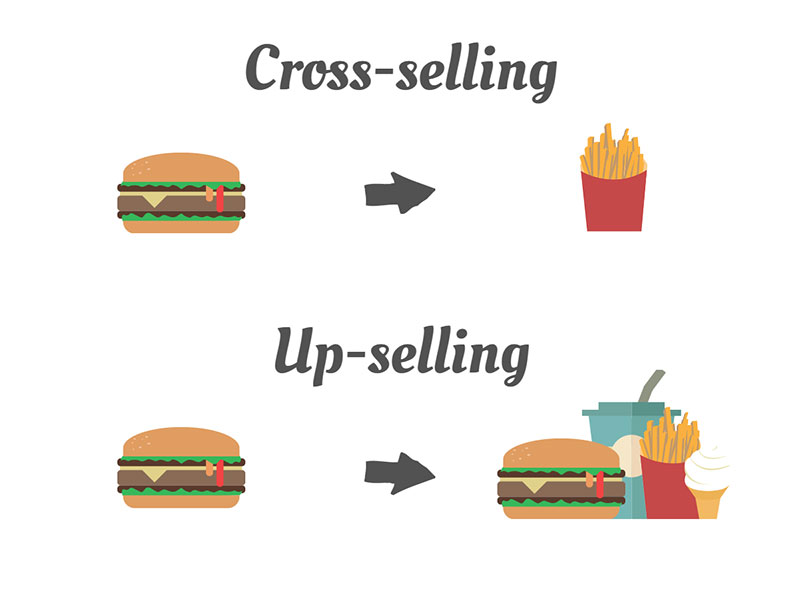

- Cross-selling — the selling of additional products and services to existing customers; the best example is “would you like fries with that?”

- Up-selling — the selling of higher priced/margin products and services to existing customers; e.g. “would you like the large value meal?”

- Mass customisation — similar to specification, it allows the customer to customise their products/services according to their specifications or needs; e.g. direct delivery, touch-screen ordering

- Brand extension — extending the brand with new products/services or features; e.g. clothes, footwear, desk accessories, Visa cards, cafés, etc.

Termination

Hopefully it doesn’t come to it, but in some cases you may have to resort to the opposite of customer acquisition — customer termination.

Sometimes, businesses can find it worthwhile to shed some customers, possibly based on profit or other strategic concerns. However, any and every business needs to consider the implications carefully and thoroughly, as this type of termination may be a short term gain but could be long term losses, e.g. banks terminating loss-making student account which may turn into profitable accounts later.

Some strategies for terminating customers include:

- Raising prices

- Unbundling offers

- Respecifying products/services

- Reorganising departments (sales, marketing, service)

- Introducing ABC class service